Cutting Through Uncertainty – Looking Beyond the Election

• 4 min read

AMG National Trust

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

ECONOMY APPEARS TO BE REVVING UP, AND THE ELECTION PROBABLY WON’T SLAM ON BRAKES

The U.S. economy is on the road to recovery and that likely will continue no matter what happens Nov. 3.

But there are speed bumps that could slow it, primarily:

- What will be the government’s fiscal policy?

- When will a safe, effective vaccine be developed and distributed?

The bottom line is that investors should expect to see political disruptions and COVID-19 infection spikes, which are likely to prove temporary. Economic growth should motor uphill into 2021, even if the ride proves bumpy.

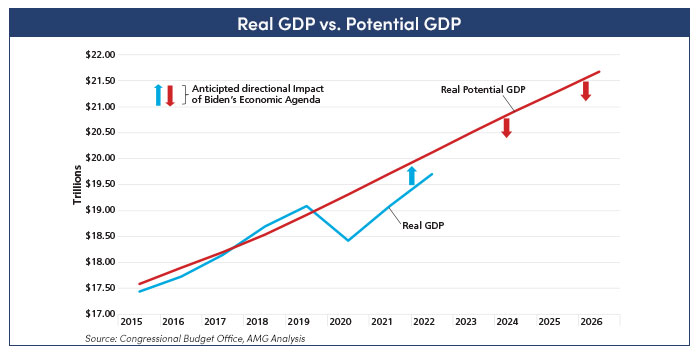

“Compared to a continuation of the Trump Administration policies, a Biden Administration’s economic program could boost economic growth in the near term, largely due to stepped up federal spending,” AMG Economist Michael Bergmann said at the company’s Oct. 27 webinar. Click here to watch the webinar.

“However, in the long term, candidate Biden’s proposed agenda for tax, regulation, and expansion of subsidies—if fully implemented—would reduce GDP growth.”

AMG’s wide-ranging presentation touched on a number of topics that bode well for a speedier recovery:

- Although new COVID-19 cases have recently surged in the United States and abroad – except for in the Far East – death rates and hospitalizations remain far below past spikes.

- Health and political authorities are shying away from total economic shutdowns, having now recognized their tremendous costs, so the risk of broad re-impositions of near-total lockdowns is substantially diminished worldwide.

- Five companies are in late-stage trials for different vaccines. Two could be ready for emergency distribution by year-end.

- Monetary policies in the United States and other countries are favorable for economic recovery. The U.S. Federal Reserve has cut interest rates to near zero and buoyed credit markets during the crisis.

- Although U.S. fiscal policies are uncertain because of the Nov. 3 election, both Republicans and Democrats appear to support another round of economic stimulus. Only the size and makeup of the relief package is in question, dependent on the election’s outcomes.

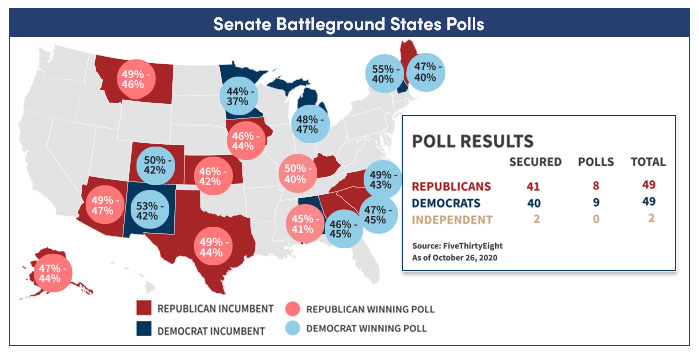

Noting recent polls indicating Democrat Joe Biden is likely to defeat President Donald Trump, AMG Chairman Earl Wright said the question is whether Republicans will continue to control the Senate. “Will there be a blue wave, or will we have divided government?”

If the election outcome is not known soon after 11/3, and/or if the result is a divided government (e.g. a Biden presidency and Republican senate), equity markets will be volatile at least through the end of the year.

“The market has been positioning itself for a blue wave,” said Josh Stevens, Senior Vice President, Investment Group. “There’s still a lot of uncertainty about what government will actually look like after the election, and this could contribute to policy uncertainty and market volatility.”

Investors and consumers, although both uncertain about the immediate future, are generally positive about the country’s economic future.

Consumers seem to understand that the pandemic and recession are temporary and that the country will get past this sooner rather than later, said Alex Musatov, AMG’s Global Research Economist. They are adjusting to their “new normal.”

“What’s very encouraging,” he said, “is the speed with which households redirected their spending to other categories: Building materials, furniture, cars, and sporting goods have recently experienced double-digit year-over-year growth.”

Labor markets have recovered about 60% of the jobs lost in the spring when the pandemic hit and government shut down most of the economy. Manufacturing is on the rise, and the yield curve is steepening; both indicate that a recovery is underway. Stock-market profits are bouncing back.

Taking those factors into consideration, investors should look at:

- Small and mid-cap stocks, along with value stocks, all of which have lagged the price recovery of larger growth stocks. Their potential for catch-up is substantial.

- Recovery in economic growth overseas, which implies a weaker dollar and improving conditions for foreign equities. Value stocks in developed and emerging foreign markets look most promising.

- New opportunities for investment that might arise from changes fostered by adjustments to COVID-19 and/or to post-election changes in tax and subsidy policies. For example, a recent population move out of dense urban areas, a growing shift to remote work, and increased government backing and mandates for renewable energy.

“It’s too early to tell what recent COVID-19 trends will stick in a post-pandemic period, or what shifts in government policies will actually happen,” AMG Economist Michael Bergmann said. “AMG will be carefully watching for developments in these areas, and then, looking for investment opportunities that capitalize on them.”

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.