Boom! Housing Crashes, Then Rebounds Within Months

• 2 min read

- Brief: Global Economy

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

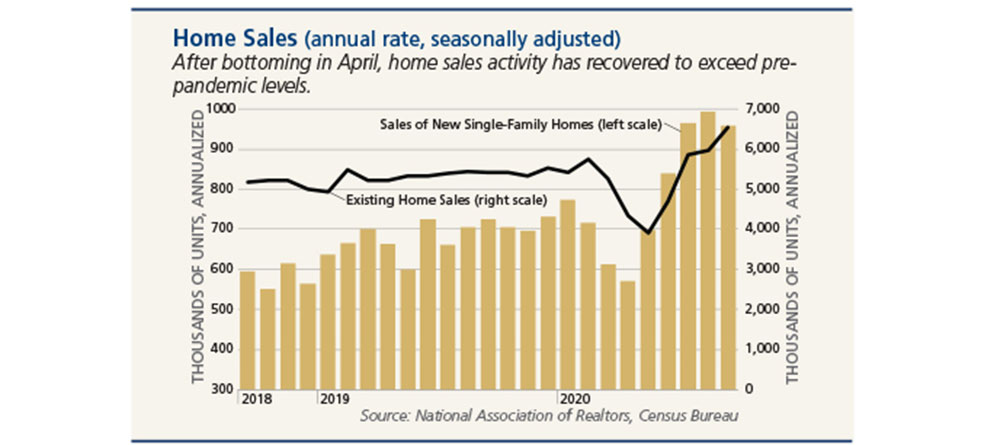

U.S. home sales and construction are through the roof.

That’s an astonishing development, considering residential investment was headed for the basement in 2020’s second quarter, falling an annualized 35.6%. Experts blamed the pandemic as personal-safety concerns and government-mandated shutdowns restrained construction and brought house-hunting by would-be buyers to a near standstill.

Then just like that, it rebounded. Home sales and construction boomed, sending housing investment up an annualized 59.3% in the third quarter, surpassing even pre-COVID-19 peaks.

Experts are crediting the Federal Reserve’s response to the pandemic, which has greatly increased available financing and driven mortgage rates to record lows. In addition, the disparate impact of the recession has left higher-income earners virtually untouched in terms of employment and incomes. However, it has led a sizeable number of such people to move out of urban centers to larger single-family housing in suburban, and even exurban, areas. The under-35 age cohort experienced the largest percentage point increase in home ownership (2.9) between the first and third quarters of 2020.

As demand soars, home prices are taking off as well. Price gains had been accelerating since the summer of 2019. The trend was interrupted when the pandemic hit. However, buoyed by extraordinarily low interest rates and brisk expansion of home ownership on top of lean inventories, home-price appreciation has accelerated. Rising prices coupled with lean inventories created by surging demand means affordability will become a greater problem for buyers going forward.

Looking ahead, the 50%-plus growth rate in residential investment is obviously unsustainable and will probably be more than cut in half in the fourth quarter, and growth going forward will be much more modest. Further, it appears that the pandemic created a perfect storm of conditions that blew home-ownership demand forward. That will lead to a reduction in future demand relative to what would have otherwise taken place. This is likely to happen in 2021, causing investment to slow substantially in the first half before modestly declining in the second half.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.