National Financial Literacy Month: Get Smart With Money

• 8 min read

- Brief: Wealth Management

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.

Do you track income and spending? Do you have a student loan and understand the terms? Are you saving in tax-advantaged accounts? Can you explain how different asset classes can diversify your investment portfolio?

Knowing the basics of personal finance—such as how to create a budget, invest in markets, or set savings goals—may help you avoid making poor financial choices and help you find opportunities.

APRIL IS NATIONAL FINANCIAL LITERACY MONTH

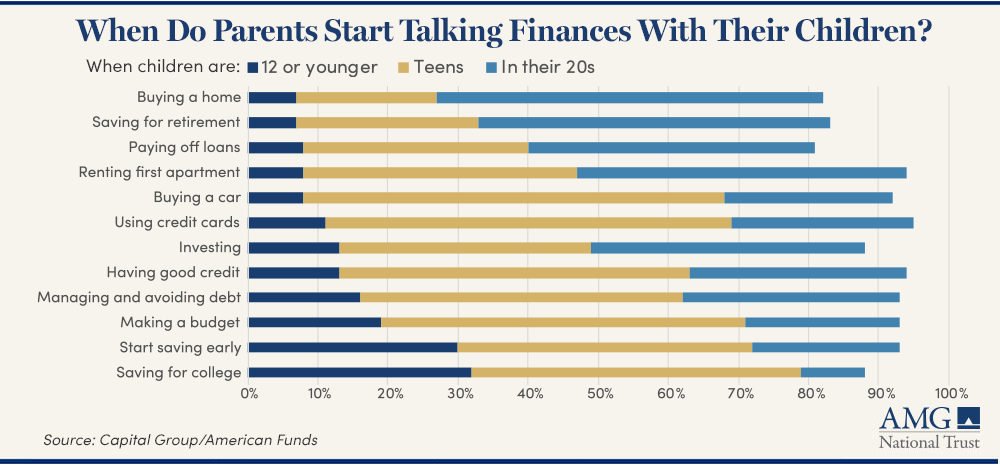

Financial education may be best when it starts early.

Confidence in financial matters is something that parents can pass on to children. When they don’t, their children may have to live with the consequences for years to come.

FINANCIAL LITERACY BUILDS ON 5 PILLARS

There’s value in learning how money works, how it can be spent—prudently or carelessly—and how to save it.

A good starting point is understanding five pillars of financial literacy:

1. Income

Income comes primarily from hourly wages or salary, but can include Social Security payments, pensions, child support, public assistance, annuities, money derived from rental properties, interest, and dividends.

Also, consider non-cash benefits such as employer-sponsored retirement plans or employer-subsidized health, disability and life insurance. Taking full advantage of offered benefits such as making pre-tax payroll deductions or maxing out employer matching contributions can meaningfully add to net-of-tax income.

2. Spending

The tally of what Americans spend each month comes to a pretty penny. The Bureau of Labor Statistics reports that the median income among U.S. households was $70,784 in 2021, and the median consumer expenditure was $66,928. The largest expense was keeping a roof over our heads.

Caution about spending beyond means.

Spending adds a measure of daring when you start borrowing for items you could not otherwise afford. This does not mean credit is a bad thing. Having several credit cards and using them responsibly can substantially improve your financial picture and borrowing to buy a home or fund a college education can be considered an investment in the future. But not so much when spending impulsively on “wants” rather than “needs.” The risk is the fallout from missed payments: a lowered credit score, potentially higher borrowing costs, and other headaches.

RELATED ARTICLE: Can You Have Good Income But Bad Credit?

3. Saving

Think of savings as your nest egg. The term comes from farmers who put eggs in hens’ nests to stimulate them to lay even more eggs, just as putting money in a savings account or another investment will potentially help it grow.

Creating a budget can help determine how much you can afford to save after paying your bills. Lay out your goals, such as saving for retirement or buying a house. It is often OK to start small because meeting a smaller, short-term goal can provide a large psychological boost.

You may choose to pay yourself first each month with an automatic transfer into an account separate from your checking. Putting money in an isolated savings account, for example, can help avoid the temptation to spend it on something other than its intended purpose. Savings accounts are very popular; many households have a separate savings account. If kept at a federally insured bank or credit union, deposits may be federally insured up to $250,000 and may earn modest interest.

When opening a savings account, be sure to read the fine print on whether you’ll be charged if a balance drops below a minimum amount, and what amount needs to be in the account to earn interest.

You should also think about tax-advantaged savings and investing accounts such as an employer-sponsored 401(k) plan, an Individual Retirement Account (IRA), a 529 college savings plan, or a Health Savings Account (HSA).

4. Investing

While the stock market can produce tremendous wealth—for nearly the last century, the average annual return has been about 10%, as measured by the S&P 500 Index—it also typically will decline. Annual inflation rates and fees are additional factors to be considered.

During periods of market volatility, you may hear the recommendation to “buy the dip,” which is a version of the “buy low, sell high” mantra. The problem is that you must know you are on the cusp of a prolonged rise in order to realize the motivating short-term benefit from buying the dip. That is easier said than done.

Instead, many investment professionals aim to smooth out the declines for an investor and increase the potential for gains by diversifying the portfolio through asset classes with varying risk levels such as equities (stocks), fixed income (bonds), cash and cash equivalents (Treasuries, money market funds), and alternatives (real estate, foreign currencies, cryptocurrency).

The importance of diversification to an investor is that typically during a downturn not all the asset classes in your portfolio will behave the same. In fact, you’re counting on some to have a negative correlation with each other, meaning some may potentially rise in value as others decline. The outcome is a potentially lower volatility and smoother returns over time.

| Asset Class | Risk of Loss | Growth Potential |

| Cash and cash equivalents | Very low | Very low |

| Fixed income | Low | Low |

| Equities | High | High |

| Alternatives | Varies | Varies |

Stocks, ETFs or Mutual Funds.

They are not the same. A stock is a share of an individual company. A mutual fund is a portfolio that includes a variety of securities such as stocks and bonds. An exchange-traded fund (ETF) is like a mutual fund in that it typically holds a variety of securities, but it may be traded intraday whereas a mutual fund’s net asset value is priced at market close.

5. Protecting

Emergency savings can help alleviate anxiety from an unexpected car or home repair, but insurance can be a helpful tool to protect against a catastrophic loss.

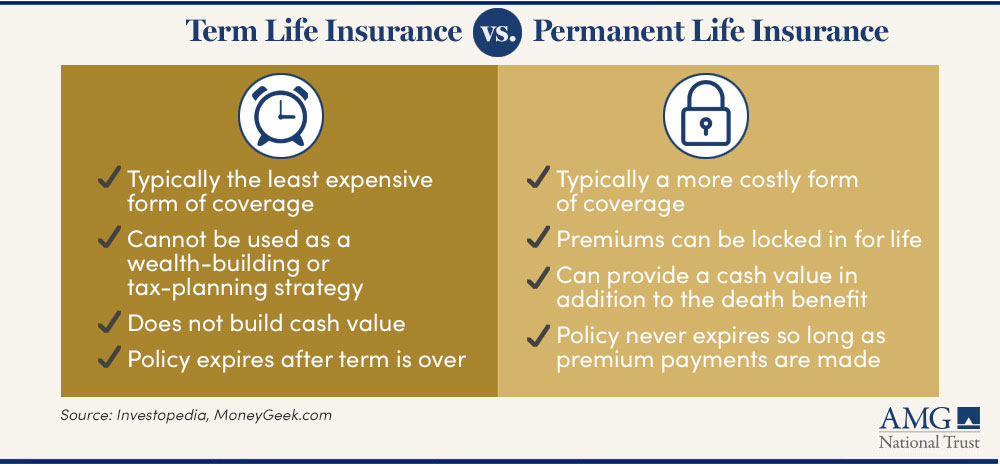

- Life insurance. There is no single answer to how much you may need. Many focus on calculating the income you hope to replace, such as annual income, mortgage and other large debts, children’s school tuition, funeral costs, and other expenses. You should shop around for quotes and examine the merits of term or permanent policies.

- Disability insurance. Up to one in four adults in the U.S. have some type of disability, according to the CDC. Disability insurance offered through a workplace group policy or purchased individually can supplement or replace lost income.

- Property and casualty, and vehicle insurance. Provides coverage for damage to your own property or belongings such as a home, car, boat, furniture, and other items, as well as liability insurance for damage done to others or their property.

- Health insurance. Your employer may offer coverage options and subsidize part of the cost of health insurance. If you are older or have health concerns, you may prefer a higher-premium/lower-deductible policy. If you are younger and in good health, a policy with a lower premium but a higher deductible may meet your needs. Anyone looking to buy their own policy can search the private insurance marketplace in your state, many of which offer subsidies. Federal health insurance through Medicare is also an option for Americans starting at age 65.

- Trusts & estate planning. Few of us like to plan for the time after we are gone but doing so now can help educate loved ones about your finances and how your estate may pass on to them. Having a minor in your home increases the need to communicate your wishes for their upbringing, to recommend how they might initially handle an inheritance, and to potentially consider setting up the legal structure in the form of a trust for them to be able to receive any insurance policy distributions.

RELATED ARTICLE: End of Life Planning: Are you Good to Go?

HOW AMG CAN HELP

AMG is a trusted resource for many families, especially those with complicated financial lives. We’re here to help you build and manage your wealth. To find out more about AMG’s Personal Financial Management (PFM) or to book a free consultation call 303-486-1475 or email us the best day and time to reach you.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such.

FREQUENTLY ASKED QUESTIONS

WHAT IS FINANCIAL LITERACY?

Financial literacy means you understand your relationship with money and have the skills to manage your income and spending, to save and invest for key life goals like funding a child’s education or retirement, to protect your assets from catastrophic loss during your lifetime, and to tax-efficiently transfer your wealth leading up to or upon your death.

WHAT ARE THE CONSEQUENCES OF NOT BEING FINANCIALLY LITERATE?

Not being financially literate can lead to poor spending and savings habits, investment mistakes and a history of poor credit, all of which may impact your daily life.

This information is for general information use only. It is not tailored to any specific situation, is not intended to be investment, tax, financial, legal, or other advice and should not be relied on as such. AMG’s opinions are subject to change without notice, and this report may not be updated to reflect changes in opinion. Forecasts, estimates, and certain other information contained herein are based on proprietary research and should not be considered investment advice or a recommendation to buy, sell or hold any particular security, strategy, or investment product.

Get the latest in Research & Insights

Sign up to receive a weekly email summary of new articles posted to AMG Research & Insights.